Real Estate Advice

Get the latest buyer and seller expert advice, and local news.

Coastal Neighborhoods: Scituate Cliffs

Nestled along the Atlantic coast, Scituate, Massachusetts, stands out among South Shore residential towns for its charming coastal neighborhoods. …

Waterfront Real Estate: Pros and Cons

Navigating the Waters The allure of waterfront living is undeniable. The gentle lapping of waves, stunning views, and …

What is smarter: renting or buying?

The age-old debate of buying vs renting a home has been a topic of discussion for many years. …

Best South Shore MA Beaches

Are you craving sun, sand, and sea along the picturesque Southern Coast of Massachusetts? Look no further! South …

5 Most Expensive Towns: South Coast of Boston

Looking to move to the Boston suburbs? The South Coast offers a perfect blend of suburban charm and …

How to Find a Mortgage Lender

Buying a home is one of the most significant financial decisions you will ever make. From a first-time …

What is the Difference Between Beachfront and Waterfront …

When it comes to real estate, location is everything. And for many people, nothing beats a property with …

Top Reasons to Live in South Shore MA

Is South Shore MA a good place to live? Absolutely! From a perfect blend of coastal beauty to …

Top 4 Home Pricing Strategies

A Comprehensive Guide to Pricing Strategies and the Role of a Local Realtor Are you contemplating selling your …

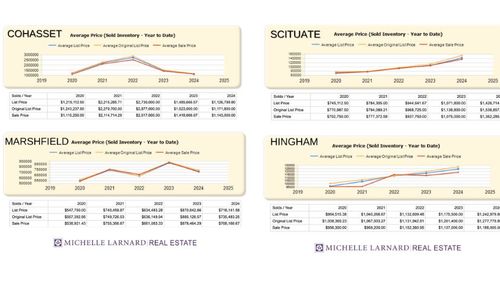

Local Home Prices: Year over Year

As we step into 2024, the South Shore real estate market is thriving. In fact, local South Shore …